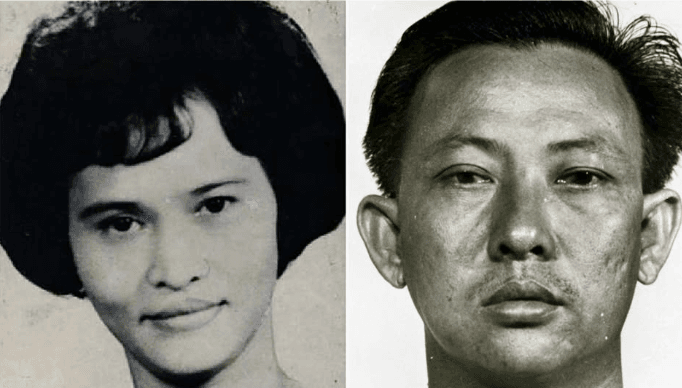

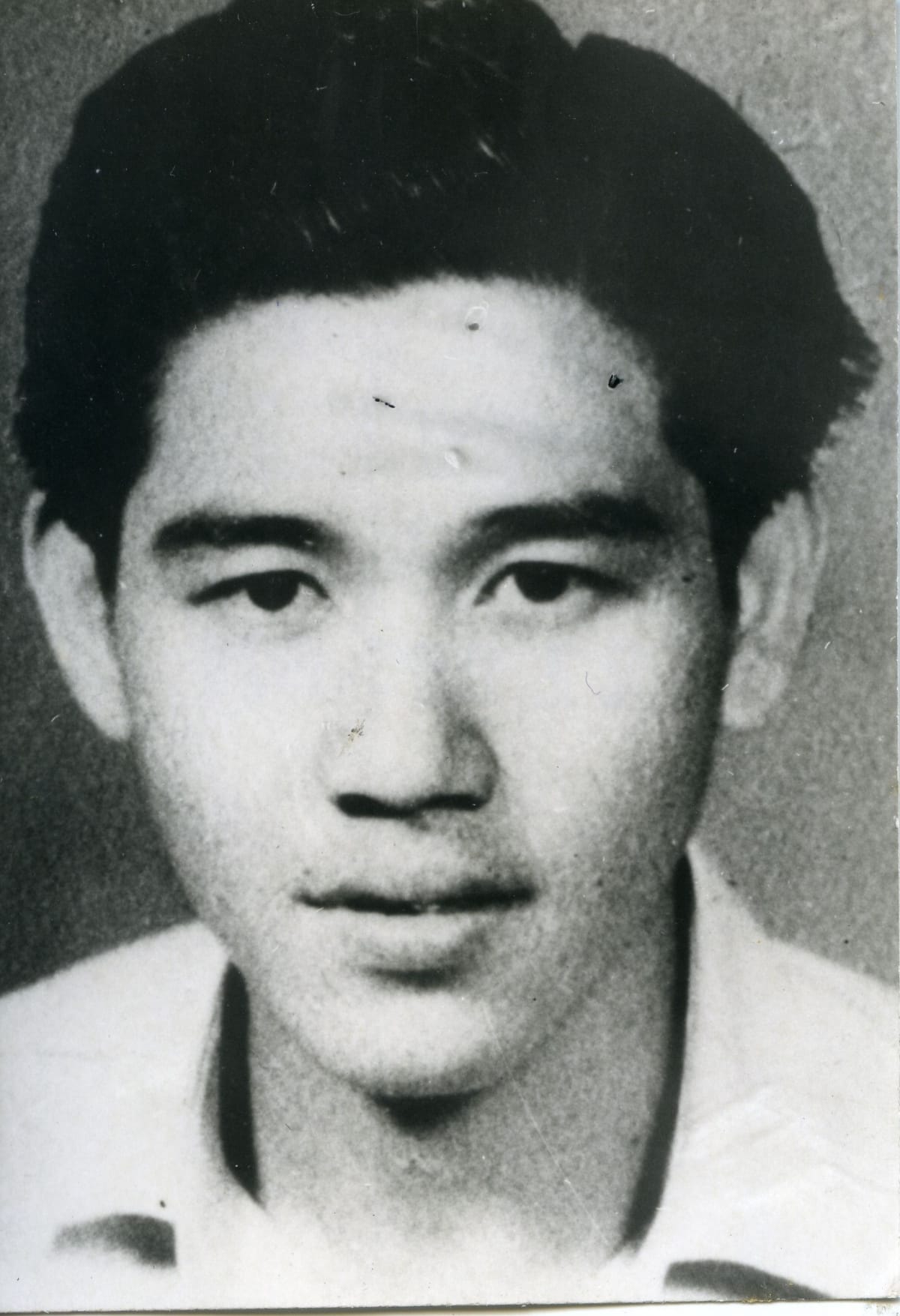

Source: Police File Photos

Chia Teck Leng appeared to be an unremarkable family man—living in a Serangoon Road condominium with his wife and two teenage sons, holding a respected position as a financial manager at Asia Pacific Breweries (APB).

But beneath this façade was a high-rolling hustler who swindled four banks out of $117 million to fuel his gambling addiction, making his case one of Singapore’s largest commercial frauds.

The Rise and Fall of a High-Stakes Gambler

Chia’s gambling habit began as early as 1994 while he was a financial controller at Swire Pacific Offshore. Initially, he enjoyed winning streaks that saw him amass around $1 million in casino earnings. However, his luck ran out in 1998, plunging him into massive debt. Unable to repay his dues, he faced mounting pressure from creditors. Desperate, he turned to fraud.

Between 1999 and 2003, Chia forged documents to open fraudulent bank accounts in APB’s name, securing massive loans and credit facilities from Skandinaviska Enskilda Banken (SEB), Sumitomo Mitsui Banking Corporation (SMBC), Mizuho Corporate Bank, and Bayerische Hypo-und Vereinsbank Aktiengesellschaft (HVB). By manipulating financial records and forging director signatures, he maintained sole control over these accounts, channeling funds into his personal bank accounts before wiring them to casinos across Australia, Britain, Hong Kong, Malaysia, and the Philippines. To ensure his deception remained undetected, he carefully orchestrated repayments, rolling funds between accounts to create the illusion of legitimate transactions.

The Lavish Lifestyle and the Mistress

As the illicit funds rolled in, Chia’s gambling stakes increased. He became a regular high roller at offshore casinos, where operators would fly him in on private jets and treat him to luxury accommodations. He often gambled with single bets as high as A$400,000 at Melbourne’s Crown Casino.

His extravagant lifestyle extended beyond the casinos. He purchased a $150,000 Mercedes-Benz, stayed in the most expensive suites with butler service, and spent hundreds of thousands on gifts for acquaintances. Chia made sure his personal life reflected the high-rolling image he projected in casinos.

In 2002, Chia met 22-year-old Li Jin, a Chinese national working as a croupier in a VVIP casino room. After winning $1 million from her, he considered her his “good luck charm” and pursued a relationship. To maintain their affair, Chia purchased a $530,000 Grange Road apartment for her and gifted her designer goods and jewelry. He even obtained a $10,000 forged passport so she could enter Singapore undetected. She used the fake passport on multiple occasions before she was caught and sentenced to six months in jail.

The Arrest and Sentencing

Despite his meticulous scheme, the Commercial Affairs Department eventually caught wind of Chia’s fraudulent activities. His downfall was triggered when banks began reviewing irregularities in loan agreements and financial transactions under APB’s name. Once suspicions arose, authorities moved swiftly. He was arrested on September 2, 2003. Investigations revealed that of the $117 million he withdrew, only $34.8 million was recovered. Authorities estimated that he had lost $62 million to his gambling addiction, with the remaining funds unaccounted for.

In 2004, Chia was sentenced to 42 years in prison—the longest jail term for a commercial fraud case in Singapore’s history. At his sentencing, High Court Judge Tay Yong Kwang remarked, “Bankers knocking on his door were there to meet the man… but the man they met was unfortunately in the business of forgery.”

Legal Fallout and Industry Lessons

Chia’s fraudulent dealings also had repercussions beyond his personal sentencing. The four banks that had extended credit to him attempted to sue APB for repayment of the loans. However, the courts ruled in favor of APB, noting that the banks had ignored proper banking procedures and failed to conduct adequate due diligence. Justice Belinda Ang, in her judgment, criticized the banks for making themselves “easy prey” by overlooking discrepancies that should have been obvious.

The case became a cautionary tale for financial institutions, highlighting the necessity of rigorous checks and internal safeguards to prevent fraud.

Lessons from a Fallen Fraudster

While behind bars, Chia penned a 13-page paper titled Taming the Casino Dragon, offering insights into the world of high-stakes gambling and reflecting on his downfall. In it, he admitted, “Like an inexperienced teenager succumbing to the lure of a newly discovered vice, I was soon hooked.”

His case serves as a cautionary tale—an extraordinary example of how a respected executive fell from grace, deceived major financial institutions, and ultimately paid the price for his crimes. The story of Chia Teck Leng remains one of the most shocking financial crimes in Singapore’s history, serving as a stark warning about the dangers of unchecked greed and addiction.

Stay tuned for more shocking cases in our ‘Singapore’s Most Notorious Crimes’ series.