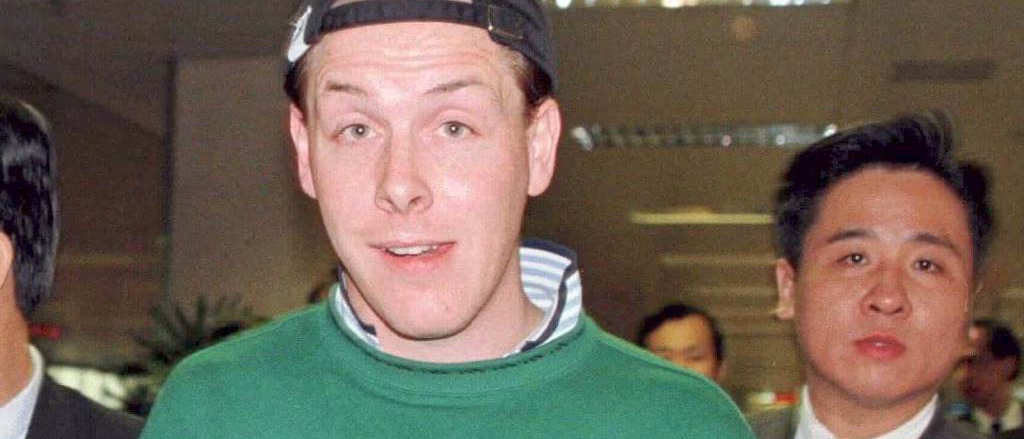

At just 28 years old, Nick Leeson single-handedly brought down Barings Bank, Britain’s oldest merchant bank, with reckless and unauthorized trading that led to $2.2 billion in losses. His actions not only caused the bank’s collapse but also triggered a worldwide financial scandal that sent shockwaves through the industry.

Rise of a Financial Star

Leeson joined Barings in London in 1989 at the age of 22. A year later, he was sent to Jakarta to sort through a backlog of contracts worth £100 million. His success there cemented his reputation, and in 1992, he was posted to Singapore. Despite failing his A-level mathematics, he was hailed as a “whiz-kid” trader.

Within a year, Barings Futures Singapore, under his leadership, saw its after-tax profits jump from $2.7 million in 1992 to over $20.3 million in 1993. As a result, he was entrusted with proprietary trading for the entire Barings group. He focused on Japanese government bonds, Nikkei 225 futures, and options, seemingly generating massive profits for the bank.

The Secret Account That Hid Millions in Losses

While Leeson appeared to be a financial genius, behind the scenes, he exploited his dual role as both chief trader and head of settlements to manipulate accounts. He used a secret “error account 88888” to conceal losses, making Barings’ trading books appear profitable when, in reality, he was sinking deeper into debt.

By December 1994, unbeknownst to his superiors, Leeson had accumulated losses of $373.9 million. Desperate to recover, he made a catastrophic bet against the Nikkei index dropping below 19,000. However, the Great Hanshin Earthquake struck Kobe on January 17, 1995, sending stock prices plummeting. His gamble backfired, compounding Barings’ losses to an astronomical $932 million.

The Collapse of Barings Bank

In early 1995, auditors detected a £50 million discrepancy, setting off alarms. By mid-February, the full extent of the damage was revealed—losses had ballooned to $2.2 billion, exceeding the bank’s total capital and reserves. Barings was insolvent.

Realizing the inevitable, Leeson fled Singapore with his wife on February 23, 1995. They drove across the Causeway into Malaysia, stayed briefly in Kuala Lumpur, and later checked into the Shangri-La Tanjung Aru Beach Resort in Sabah. By March 1, they were on a Royal Brunei flight to Frankfurt, where German authorities, acting on an international alert, arrested him upon arrival.

Trial and Aftermath

Leeson fought extradition but was eventually returned to Singapore on November 23, 1995. His trial, attracting worldwide media attention, lasted just three days. He pleaded guilty to two charges of fraud and was sentenced to 6½ years in prison.

While incarcerated, he authored Rogue Trader, detailing his reckless trading and its devastating consequences. His story was adapted into the 1999 film Rogue Trader, starring Ewan McGregor. That same year, he was released for good behavior.

Barings Bank, once a financial powerhouse that managed the Queen’s accounts and funded historic wars, was sold to Dutch bank ING for a symbolic £1.

Leeson’s fall from grace remains one of the most infamous financial scandals in history, a cautionary tale of unchecked power, lack of oversight, and the perils of high-risk trading.